Experts are concerned about the way COVID-19 has affected the economy, with their primary concern being young adults with large spending habits.

Young people who seek financial advice tend to have similar spending habits, says Michael Leonardelli, a wealth adviser with The Pension Specialists.

“They don’t save, they live in the moment. They spend what they earn and in some cases spend more than what they earn,” said Leonardelli. “They have that YOLO [you only live once] mentality; they’re not worried about what their life is going to look like at the age of 55 and beyond.”

But young adults who spend more than what they earn and incur financial debt are in danger of doing harm to their credit score, which will affect their ability to make major purchases.

Opening up a credit card account should be the first step into building your credit score, says Leoanardelli.

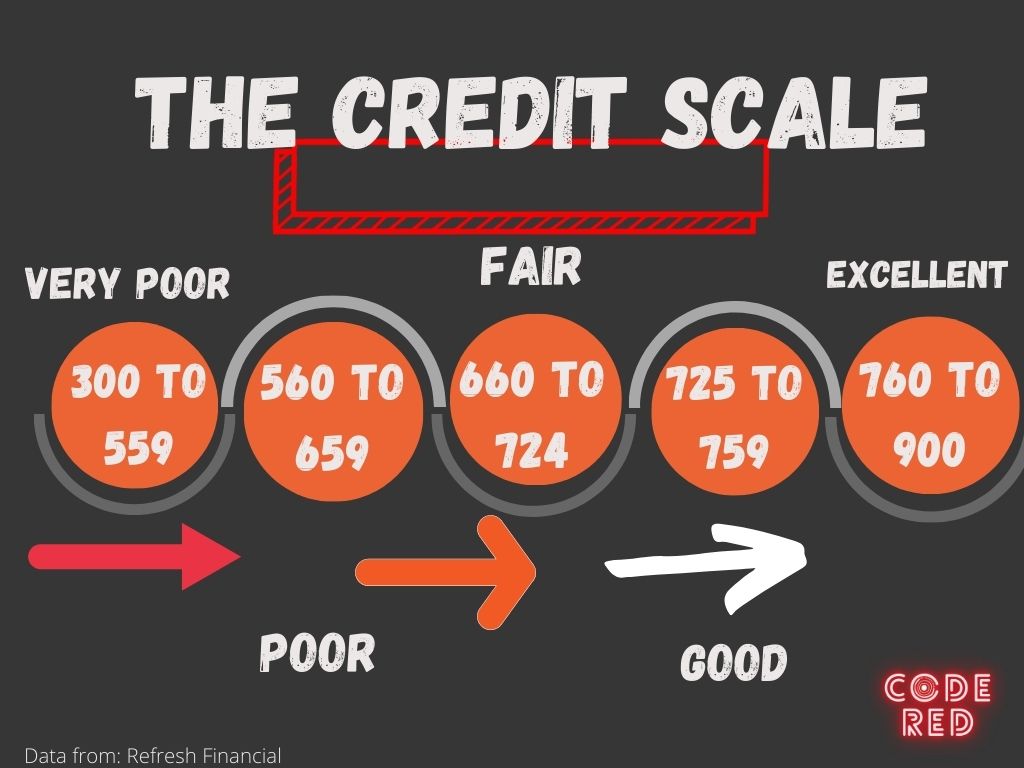

A credit score is a three-digit number that comes from an individual’s credit report. It identifies how well the credit card and other debt is being managed. The credit report analyzes an individual’s income, which helps organizations determine if it’s safe to lend money.

In Canada, the credit score ranges from 300 to 900. According to TransUnion, the average credit score in Canada is 650.

In order to build credit a credit card has to be used responsibly, meaning monthly payments shouldn’t be overdue as additional interest payments will have to be made. This contributes to lowering the credit score. In order to prevent this issue, set a reminder to make the credit card payments on time and make sure you don’t overspend for the month.

The long-term effects of having a poor credit score would alter a person’s chance of being approved for things such as a car loan or a mortgage.

“The first thing that the banks or institutions will do with large purchases is that they are going to run your personal credit score and look at your income,” said Leonardelli.

He says that if you have poor credit, lenders will ask for someone as a backup — or co-signer — to make the payments if you can’t. But it’s best to prevent this as it could impact both parties’ credit scores.

A co-signer, also known as a guarantor, is an individual with credit history who reassures the lender that monthly payments will be made. They’re responsible for making payments when the primary borrower fails to do so.

It’s best if a deal could be made without a co-signer, because a future potential creditor will factor in the previous co-signed loan, which could potentially be the reason a person is rejected for a loan.

When qualifying for a big purchase such as a house mortgage, banks conduct a stress test where individuals have to qualify at an interest rate of two per cent higher than the expected mortgage rate to ensure monthly payments could be made comfortably.

Zahraa Khalaf, a third-year student at Ted Rogers School of Management, said that the main thing she learned during the pandemic is the significance of saving money and being financially responsible with her credit card.

“I’ve never been taught how to use my credit card. Pre-COVID I used to overspend and I wasn’t able to pay off my debt in time. I had to pay interest in addition to my purchases,” said Khalaf. “I’m now more mindful with my spending habits, I recently came to the realization about the importance of having good credit and I make sure to pay off my credit debt in time.”

Alykhan Dhanji, a fourth-year business management student at Ted Rogers School of Management, said: “The thought of building my credit score crossed my mind and I started to build my score up right before the pandemic hit. It’s important to be disciplined while using the credit card as you can easily get carried away with your spending limit.”

As students approach their graduation date, their priority is to pay off their student debt. “One piece of financial advice I’d give my younger self is to start investing; the more money saved the easier it will be to pay off the student loans,” said Dhanji.

Hadi Azad is the Education Reporter of On the Record for the Fall 2021 semester.

This article may have been created with the use of AI tools such as

Hadi Azad is the Education Reporter of On the Record for the Fall 2021 semester.