In 2012, during his second year of university, Ethan Lou was scrolling across the dark web one day when he came across something different than what usually dominated the space. It was a reference to a digital currency called Bitcoin.

Why was it on the dark web?

Later that year, Lou was interning at a newspaper in New Brunswick, the Telegraph-Journal, where he got to interview Anthony Di Lorio who’d go on to be the co-founder of Ethereum (a cryptocurrency). That is what got Lou taking it more seriously.

Di Lorio made a crypto price prediction at that time. Lou said, “Some people are leery of making price predictions because you always end up on the wrong side of history.” But Di Lorio’s price prediction turned out to be correct quite soon — by 2013.

“That was when I first bought crypto. And that is how I went down the rabbit hole,” said Lou.

Cryptocurrency is digital currency that functions in the same way as any other legal tender for buying goods and services. It’s a highly volatile market and that brings with it the attraction of making large profits in a short time. With multimillionaires and billionaires like Elon Musk, founder of SpaceX and Tesla, starting to invest in it and promoting it, many people are following suit.

But as cryptocurrency booms, so does its dark market.

Cryptocurrency has evolved to the stage where it is here to stay. But that doesn’t mean that there aren’t still big questions swirling around it. How safe is the Bitcoin market? Is it really as egalitarian as it seems? How environmentally friendly is it?

When Lou made his initial crypto investment, his in-depth research started as well.

At one point, he came across what was advertised as a crypto workshop. “It turned out to be basically like a multi-level marketing scheme,” said Lou. “They were using the name of crypto, and they were saying that they had a crypto project, but it was, in fact, basically the same as any other pyramid scheme in the past. And these are quite prevalent.”

Beyond the crypto basics, majority investors are uninformed about the intricacies of the market.

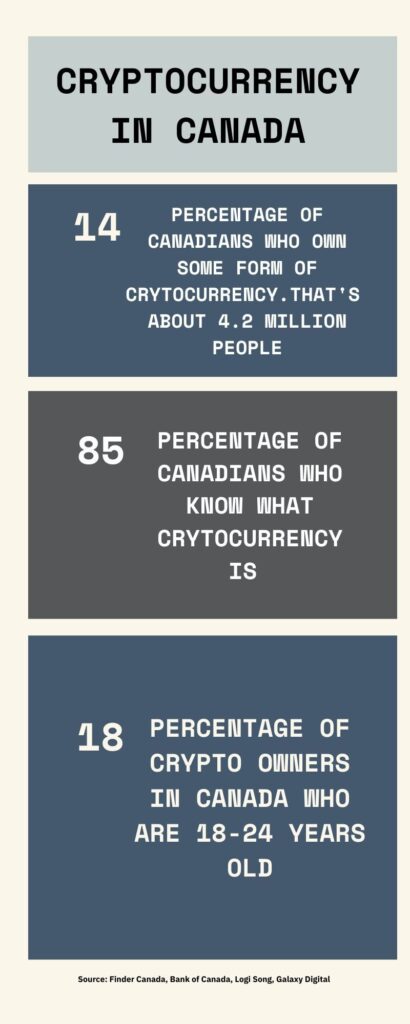

According to Finder Canada’s latest study, 4.2 million Canadians — or 14 per cent of the adult population — own some form of cryptocurrency. According to the Bank of Canada, more than 85 per cent of Canadians know what cryptocurrency is.

But in the eyes of marketing and investment adviser Alexandre LaFrance, many junior investors are poorly instructed and become the prime targets of the “pump-and-dump” scams that run the dark market of cryptocurrency.

Lou, a Ryerson journalism school alumnus and author of the book, Once a Bitcoin Miner: Scandal and Turmoil in the Cryptocurrency Wild West, elaborated on this cluster of stakeholders: “I think crypto is often talked about and the group itself is not always spoken to. “And I do think most investors have only a surface-level knowledge. But I think you can say that about most retail investors on anything. People are very easily taken advantage of by unsavoury characters in crypto.”

One such character is a 22-year-old Canadian male who goes by the alias Logi Song. Song has been an active participant in these scam groups.

“All we did was participate in pump-and dump-schemes to get money from suckers,” he said.

He reflects on their legacy as one that stole money from people who received nothing in return but the dream of compensation. “I had my circle and connections. … They were all greedy sociopaths who deserve nothing, but get everything. … Same with me, unfortunately.”

But Song was in too deep when he realized his hate for the scam culture. Despite helping him reach his financial goals, Song said crypto fraud became a sick obsession. He was infatuated with money and jealous of people who made more.

“It killed all my motivation to live my real life,” said Song.

“It ruined my worldview because, in 2020, I worked hard to get my life together and get a job without crypto. But if I can just make money by soft scamming people, what was the point of all this hard work? It makes me feel sick to enjoy anything and makes me hate humanity.”

He refers to it as soft scamming, since the people running the show are not the ones who created the scheme. He says the creators take advantage of people who enter the market without sufficient knowledge.

Song notes that many people running these groups are between the ages of 18 and 22. And so are the targets.

“For the people who know what they are doing, it is not even a risk. For them, a bad day is when they don’t make enough money. The noobs (new people without sufficient knowledge) are the ones with all the risk, and of course, some noobs win.”

The demographic with the largest share in cryptocurrency is the 18-24 age group. They hold 18 per cent of the Canadian crypto market -— which is one of the biggest crypto markets in the world right now, according to research by TripleA, a cryptocurrency exchange.

What helped this happen is that Canada became the first country to pass a digital currency law, in 2014, and since then has hosted a friendly-yet-regulated crypto investment and trading market, as well as becoming a leading market for ETFs and NFTs.

One of the many Canadians who started investing around that time, is Julian Figueroa. In 2015, while he was a student, his life changed for the better thanks to cryptocurrency investments. He is now a crypto educator and runs a YouTube channel.

He says that 70 per cent of his audience consists of young people. “I think, for the most part, they’re just looking to get into something because they see their savings accounts basically produce nothing,” he speculates.

Micah Taggart-Cox is a 19-year-old student at the University of British Columbia. His love for coins goes way back — before digital coins were even a thing. “I’ve been into physical coin collecting since I was really little and got more into coins and silver collecting since COVID.”

He bought crypto for the first time in December 2020. “When I first bought crypto, I didn’t really understand much about markets or crypto, so I just kinda yolo’d (you only live once) and figured out how everything worked afterwards.” He said that almost all the people his age who start investing in crypto “yolo some money into something they see online.”

Since school went online, Taggart-Cox said students have saved more, and as a result have started investing. He has also seen students invest and lose all their student loan money in GameStop, Dogecoin and other internet-hyped meme investments. “I have seen statistics that quite a lot of people invest with borrowed money.”

Based on what he’s seen on Reddit, Taggart-Cox reckons that there are “more former students (who) borrow money to invest in risky assets to pay off their student debt than current students would.”

“Crypto projects actually gain a lot from the greed of newcomers,” said Figueroa. Too often, he sees people driven by the fear of missing out on something that they read about on social media.

His advice is that if a coin (cryptocurrencies are also referred to as coins) is already going up and there is a lot of chatter online, it’s probably already too late. “There are instances where you might be able to make money if you happen to be early to one of these things. But most of them are pump-and-dumps.”

Taggart-Cox said that when he started investing, he didn’t have any specific goal. For him, “it’s a very financially driven hobby. But I do think crypto, in some form, will make the world a better place, so that is another part of it.”

Figueroa said that this specific do-good motivation is a general trend for young investors. “They want to get into something that they think is kind of the future of currency and is also good for the world.”

To someone like Figueroa, dominant currencies come with a marked history.

“Throughout history, countries with dominant currencies have been able to hold on to that status because of violence. They’ve started wars. They’ve been aggressive nations,” he said. “Bitcoin represents the opposite of that.” He explains that Bitcoin represents a more egalitarian philosophy by shifting the power of currency control from the governments to the people.

“I think people nowadays, especially younger people, are very conscious of the morality of what they invest in,” said Figueroa. “They want to invest in things that are environmentally friendly, socially responsible, and things like that. And Bitcoin is probably the most socially responsible investment you can get into.”

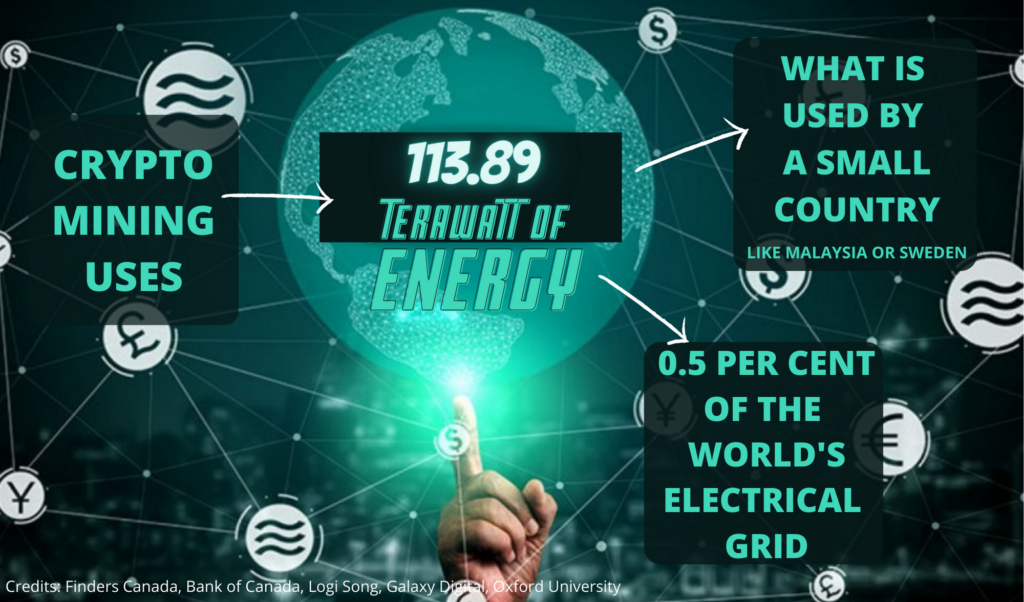

However, its environmental footprint has become questionable. According to research by Galaxy Digital, Bitcoin consumes 113.89 terawatt-hours (TWh) per year globally. Based on the Canada Energy Regulatory body, each Bitcoin mined uses more electricity than one Canadian household does in a month.

As stated in the report, one of the main reasons cryptocurrency miners are interested in operating in Canada is the relatively cheap electricity, lenient regulations and the cold weather, which helps keep servers cool.

Crypto mining is the process of earning cryptocurrencies by solving complex equations through the use of computers. This involves validating data blocks and also adding transaction records to the ledger where all cryptocurrency transactions are stored. It’s called a blockchain and is a public ledger. But the process involves extensive computer processing, which consumes a lot of energy.

When Lou started crypto mining, he set up his workstation at a coffee warehouse. While the warehouse required a lot of space for the coffee equipment, it didn’t need much electricity to operate it. “But they got access to a lot of electricity with a big warehouse. And we have a very small physical footprint, but we needed all of that electricity. So it was a very good marriage.”

Figueroa said that mining with fossil fuel is expensive, making it difficult to retain a profit margin.

He said crypto mining is the most economical when done through hydroelectric, geothermal or solar energy. “So if you look at all of the Bitcoin mining done in North America, about 85 per cent to 90 per cent of it is done off of green energy. And that makes it a lot cleaner than if you think about the U.S. dollar, or the petrodollar, which is very much hoisted up by the price of oil.”

According to Nasdaq, production of paper or plastic money and coins have a much larger energy footprint than cryptocurrency of the same monetary value. The energy consumption of Bitcoin mining is less than half that of the gold mining industry and less than one-fifth of what bank branches and ATMs consume, currency printing aside. Bitcoin mining also uses 0.5 per cent of the world’s grid electricity, which equals less than 0.1 per cent of all human energy production.

CBC reporter Pete Evans quotes Stanford University lecturer Jonathan Koomey saying, “It’s classic scaremongering to worry about the electricity use of new technologies. Twenty years ago, the media was full of stories about how internet usage was growing too rapidly, and reportedly destined to consume as much as half of all electricity in the world.”

So, is the crypto market a gamble or an investment?

According to 11 cryptocurrency experts (financial advisers, cryptocurrency longtime investors and researchers) interviewed for this story, it’s thorough research and a solid understanding of the market landscape that differentiates one from the other. Their consensus about newcomers in the crypto market: they need to do a lot of research before investing. Otherwise, the chances of getting scammed are very high.

Justin Wales is a crypto lawyer at K&L Gates, a global law firm. He says people need to spend hundreds of hours learning about Bitcoin to understand why it exists and realize how it solves some of the problems with government-controlled monetary systems. Exploring other projects attempting to create decentralized networks is key as well. ”At that point, you will know enough to judge where to put your money.”

Lou also offers insight to help investors make the right judgment calls. “I think one red flag is, if something is promising you returns, yeah, stay the fuck away from that. Legitimate projects do not promise you returns,” said Lou.

He says the best resource you need is a “good bullshit detector.”

“A study says that most students from elementary school all the way to university can not differentiate between actual news and what is propaganda. The most important thing is to figure that out.”

LaFrance concurs. “I wouldn’t recommend people reading the news, that’s for sure. News, specifically in this industry, is extremely manipulated both by the project owners and by other third-party people who have interests in certain investments. Ninety-nine per cent of what you see as information in the industry is oftentimes sponsored by someone without you even knowing it’s sponsored by someone.”

Another point all experts seem to agree on is to not invest borrowed money into the highly volatile market. “I don’t believe in borrowing money to purchase it (money), and I think that goes against the point of it,” said Figueroa.

For students who want to risk investing borrowed money anyway, he said to do so with student loans. “If you’re going to borrow money from someone, the government is the most accommodating. … They’re never going to bankrupt you. They’re never gonna make you sell your house. They’re gonna just wait until you can actually pay it off.”

Both sides of the cryptocurrency market — the dark and the bright — are dominated by young people. One of the main differences between people on both sides is their level of understanding of the market.

Greed and get-rich-quick approaches are amongst the leading causes of getting soft scammed. Figueroa advises to be patient. “On average, (Bitcoin) has returned 150 per cent a year. If that’s not enough for you, I don’t know what is. And if that’s not enough, then I don’t feel bad for you if you lose your money or get scammed.”

This article is not written by a financial adviser and should not be considered investing advice. Neither the publication nor the writer is responsible for any investing activity conducted based on this article.

This article may have been created with the use of AI tools such as