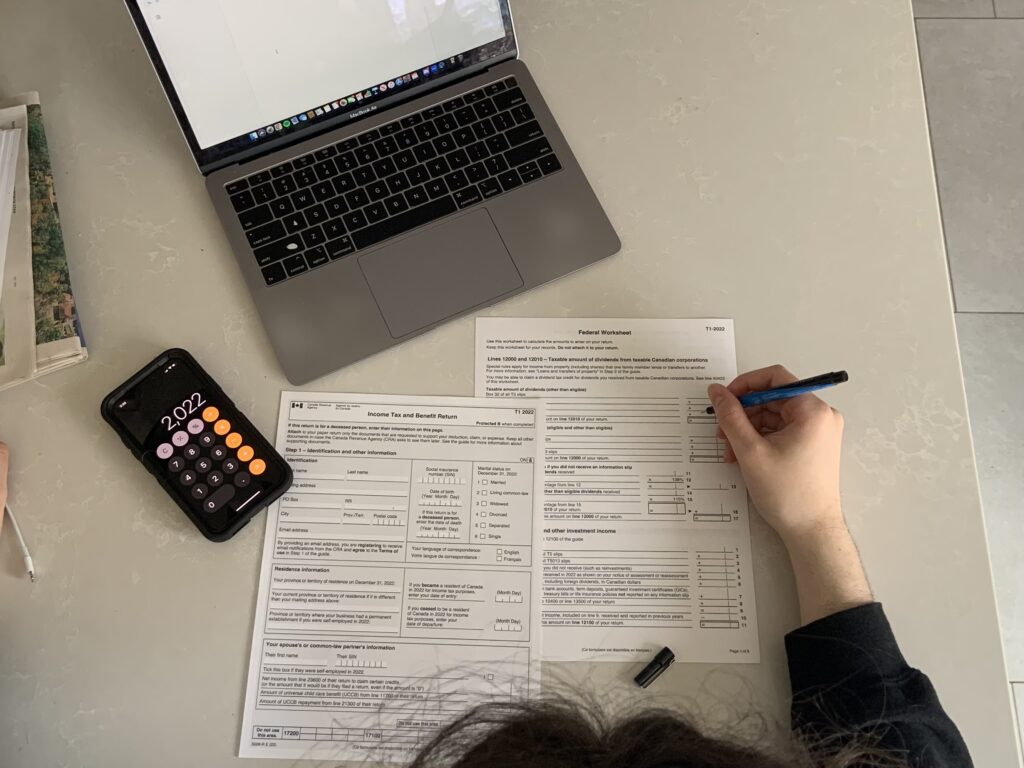

Many students are for the first time dealing with one of the two things Benjamin Franklin considered a certainty in life and it isn’t death: it’s taxes.

The deadline to file your income tax return this year is May 1, one day later than usual because April 30 lands on a weekend.

Income taxes can seem overwhelming for any first-time filers, but there are many resources available to make it all easier.

“People fear doing their taxes because they think it’s extremely complicated. They fear that they might be wrong and get arrested or something,” said Spyros Zarros, Toronto Metropolitan Student Union (TMSU) vice president of operations and organizer of the TMSU’s upcoming Tax Clinic. “Obviously that’s not the case. That was my fear at first … It’s very simple for most student’s cases” said Zarros, who will be providing hands-on help at the clinic

Experts say learning about the tax filing process now will help later.

“As you evolve and start a career or maybe become self-employed, it becomes a lot more complicated,” said Jamie Golombek, a managing director at CIBC. “Potentially you have expenses. You have to keep receipts and track those expenses: what are deductible and what are non-deductible? Maybe you buy an income property or rent out a basement … Things can get more complicated the more your life gets complicated.”

Canada Revenue Agency’s (CRA) communications manager Daria Askerko says it is critical for students to learn about what credits and deductions they are eligible for because “there’s money that could be in their pocket.” Students in particular can receive credits or deductions on their taxes for tuition and textbook fees, interest on student loans, moving costs, and more.

Deductions lower the amount of income that is taxable while a tax credit lowers the amount that someone will owe in their tax return. The Ontario Staycation Tax Credit, for instance, benefits those who stayed at a “hotel, cottage or campground” within the province during the latest tax window.

Askerko also urged student taxpayers to file online and on time. Online filing allows taxpayers to instantly send their documents to the CRA and avoid physical paperwork. The CRA says that taxpayers who are due a refund could get it within two weeks of filing. Those who file by paper might have to wait six more weeks

Among the students On The Record spoke to last week, many said they have their parents do their taxes for them. A few others mentioned they either haven’t done them yet or hire a tax firm to do the job.

The responses are consistent with the results of a Université de Sherbrooke study published in 2021 that found 27 per cent of Canadians aged 18 to 24 do their taxes through a friend or relative. Tax professionals are used by 37 per cent, while 25 per cent use tax software and seven per cent file with “pen and paper.”

Failing to get your income tax return filed on time won’t mean you will get arrested but it can be costly: Penalties for filing late start at five per cent of what you owe in taxes, then continue to climb by one per cent for every extra month that you don’t file for a total of 12 months.

Craig Fowler of the Canadian Foundation of Economic Education said understanding how the income tax system works is also important because it may save you money. “Your parents or others may not be as aware of your situation as you are,” said Fowler, who coordinates the CFEE’s Help! Managing Your Money on Campus program.

“As you go out and start working and get into your career and start to make more money, it’s great to have that foundation.”

The CIBC’s Golombek says learning how to do taxes can feel overwhelming and suggests that anyone who wants to understand taxes better should file alongside someone who has done it before.

The TMSU is running a tax clinic from Mar. 27 to April 7, and registration is currently open for those who want to book an appointment. The service provides an assistant to help students through the tax filing process.

Reporter, On The Record, Winter 2023